If the stock market was to crash tomorrow, businesses need to be confident and ready to come face-to-face with any type of financial crisis. CNN Money suggests that having an Inverse Exchange Traded Funds (ETF) guards your finances by going in a different direction than the market itself goes. Often times these ETFs move faster than the market itself. Investopedia.com says that investing in ETFs is similar to holding various short positions or using a combination of advanced investment strategies to profit from falling prices.

To stay at the top of the game, businesses need to have a financial portfolio that contains bonds, stocks, Real Estate Investment Trusts (REIT), and Treasury Inflation Protected Securities (TIPS). According to Forbes, first you need to have some bond exposure in your portfolio. Bonds offer a useful hedge to equity exposure. Bonds are a debt security that’s similar to an I.O.U, so when you purchase a bond you are basically lending money to the government, municipality, corporation, and federal agency known as an issuer. Stocks are shares in the ownership of a company. They represent a claim on the company’s assets and earnings. Investor.gov says that investing into a REITs provides a way for individual investors to earn a share of the income produced through commercial real estate ownership — without actually having to go out and buy commercial real estate. According to Forbes, REITs may be beneficial because real estate is what economists call a “real” asset that can rise in price, even if the dollar falls in value. Bonds are nominal assets, very dependent on the value of the dollar, and so would likely fall in that scenario. To further protect investments, businesses should invest in TIPS, which provides protection against inflation.

It’s not only good to protect finances during a recession, but it’s also good practice for businesses to start managing and running daily workflow effectively. If a recession does come, businesses don’t want to worry about losing extra money due to mismanagement.

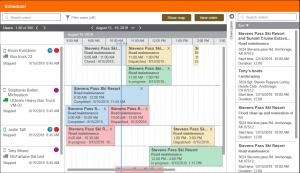

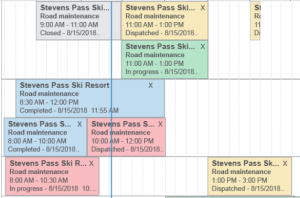

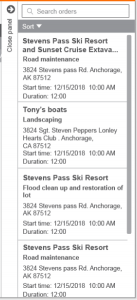

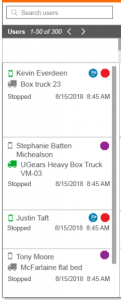

One of the ways for businesses to properly manage the nuisances of running the day-to-day business is to use our solutions. Our money-saving products can help to manage a mobile workforce more efficiently. Each feature provides businesses with the confidence they need to face any recession, such as Mobile Timekeeping, GPS Tracking, and Job Dispatching. They were designed to make the process of running a productive workflow easy.

The Mobile Timekeeping feature provides management with the ability to oversee the individual timesheets of big and small crews, all from a single mobile device, including adjusting incorrect or missed time records and integrating timesheet data directly to payroll. In GPS Tracking, management can set permissions to view tracking information on an individual or group basis, and it supports mobile devices across different time zones. Daily orders can be scheduled and generated automatically with the Job Dispatching feature.

Have any questions on how Actsoft can help you?

Share this post:

About the author : Actsoft Team

Actsoft’s team of industry experts have their fingers on the business world’s pulse. It’s our mission to deliver the latest news to keep you and your leaders on top of the latest trends, further helping you to excel and exceed your goals.

Encore & Geotab Drive

Encore & Geotab Drive

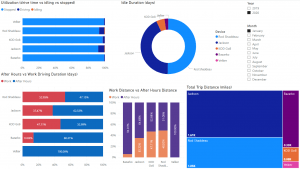

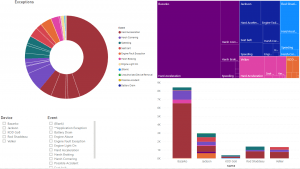

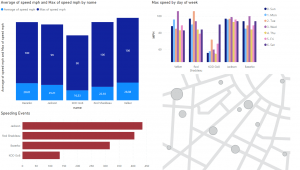

Gain even greater insight into the daily activities of your fleet using the combination of Geotab and Actsoft. Geotab devices provide detailed data collection and seamless integration with our solutions; learn more about the ways your vehicles are being used daily with the power of this tandem.

Gain even greater insight into the daily activities of your fleet using the combination of Geotab and Actsoft. Geotab devices provide detailed data collection and seamless integration with our solutions; learn more about the ways your vehicles are being used daily with the power of this tandem.

Actsoft partnered with Odin to provide our solutions overseas, through payment processing integrations. Odin helps us support user management for our software; customers can also purchase our products through Odin’s billing platform.

Actsoft partnered with Odin to provide our solutions overseas, through payment processing integrations. Odin helps us support user management for our software; customers can also purchase our products through Odin’s billing platform.

VisTracks powers our Electronic Logging Device (ELD) solution, which enables transportation businesses to easily automate their hours of service logs, remain in governmental compliance, and reduce their potential to incur costly fines.

VisTracks powers our Electronic Logging Device (ELD) solution, which enables transportation businesses to easily automate their hours of service logs, remain in governmental compliance, and reduce their potential to incur costly fines. Integration between Actsoft solutions and BeWhere’s software products is available. Take your team’s asset tracking, cellular data connectivity, and field insight a step further with effective, cross-application compatibility.

Integration between Actsoft solutions and BeWhere’s software products is available. Take your team’s asset tracking, cellular data connectivity, and field insight a step further with effective, cross-application compatibility.

CalAmp tracking devices for vehicles and assets alike are compatible with Actsoft solutions, making it easy for you to efficiently monitor your equipment and fleet cars. Help your team enhance accountability, safety, and savings through a combination of easily installed hardware and intuitive software.

CalAmp tracking devices for vehicles and assets alike are compatible with Actsoft solutions, making it easy for you to efficiently monitor your equipment and fleet cars. Help your team enhance accountability, safety, and savings through a combination of easily installed hardware and intuitive software. Our partnership with Uniden is ideal for companies looking to gain advanced diagnostics on their fleets. Uniden’s extensive product listing of car electronics like radios, dash cams, radar detectors, and in-vehicle communicators work in concert with Actsoft’s solutions to better connect your vehicles to the company headquarters.

Our partnership with Uniden is ideal for companies looking to gain advanced diagnostics on their fleets. Uniden’s extensive product listing of car electronics like radios, dash cams, radar detectors, and in-vehicle communicators work in concert with Actsoft’s solutions to better connect your vehicles to the company headquarters. Kyocera offers a wide range of mobile devices, ranging in design from traditional phones to ultra-durable handset technology. Actsoft is able to equip organizations in a variety of different industries with solutions for improved business, while Kyocera supplies the technology they can flawlessly operate on.

Kyocera offers a wide range of mobile devices, ranging in design from traditional phones to ultra-durable handset technology. Actsoft is able to equip organizations in a variety of different industries with solutions for improved business, while Kyocera supplies the technology they can flawlessly operate on.

Our software is the perfect complement to Apple’s user-friendly technology. Equip your workforce with the devices and solutions it needs for optimized productivity during daily operations with Apple and Actsoft.

Our software is the perfect complement to Apple’s user-friendly technology. Equip your workforce with the devices and solutions it needs for optimized productivity during daily operations with Apple and Actsoft.

Actsoft and Sanyo teamed up to merge intuitive business management software with the technology of today. This partnership allows us to provide you with all the tools your team needs for improved workflows, better coordination, and optimized productivity.

Actsoft and Sanyo teamed up to merge intuitive business management software with the technology of today. This partnership allows us to provide you with all the tools your team needs for improved workflows, better coordination, and optimized productivity. Motorola’s mobile technology works in tandem with our solutions to provide extra versatility to your business practices. Coupled with our software’s features, Motorola’s reliable devices make connecting your workforce simpler than ever to do.

Motorola’s mobile technology works in tandem with our solutions to provide extra versatility to your business practices. Coupled with our software’s features, Motorola’s reliable devices make connecting your workforce simpler than ever to do. We’re able to bundle certain solutions of ours (including our Electronic Visit Verification options) with Samsung devices to help your team achieve as much functionality as possible, while keeping rates affordable. Use these combinations for accurate recordkeeping, improved communication, and smarter data collection in the field.

We’re able to bundle certain solutions of ours (including our Electronic Visit Verification options) with Samsung devices to help your team achieve as much functionality as possible, while keeping rates affordable. Use these combinations for accurate recordkeeping, improved communication, and smarter data collection in the field.