This fiscal year, some companies will be faced with decreased sales, delinquent payments, and in the worst case scenarios bankruptcy. In fact, companies like Sports Authority and PacSun face bankruptcy. In recent reports by CNN Money, bankruptcy has loomed over Sports Authority since January 2016, when the company disclosed that it had missed a $20 million debt payment. According to The New York Times, PacSun was on the brink of filing Chapter 11, but they were able to file for bankruptcy protection with Golden Gate Capital, a private loan lender.

Staying out of bankruptcy can be difficult for some business owners especially when the market changes and people aren’t purchasing products the way they once were. Having a plan in place for times when sales drop and business takes a plunge for the worst, could save some businesses.

Starting a business can cost a significant amount of money. According to Intuit QuickBooks, the average cost to start a business could be between $5,000 to $250,000. A survey done by RestaurantOwner.com, based on 700 respondents, showed that the average cost to open a restaurant was $498,888.

To avoid being a victim of bankruptcy, here are some tips to help keep your business afloat:

Free Up Some Cash: Look for ways to save money! If you’re currently renting an office space or furniture, you might have to re-evaluate how you’re spending your money. If you have furniture that you’re not particularly using, sell it.

Get a Budget in Place: If your debt is accumulating each month, you’ll want to revisit your budget. Create a budget that reflects your current financial status, and make sure that your monthly costs like rent and utility bills aren’t more than your revenue.

Use Accounting Software: Keep track of your debt and budget with accounting software such as Intuit QuickBooks, Quicken, or Sage Software’s Peachtree. This software will keep your books balanced while showing you how much spending you are doing.

Minimize Debt: Don’t let debt continue to mount, plan to tackle it. Go for the highest-interest debt that you have. If you have credits cards with high interest rates, then you should concentrate your energies on paying them down first.

Consolidate Your Loans: Reduce monthly payments on your loans by consolidating smaller loans into one long-term loan package that will yield the best interest rate.

Taking the responsibility of avoiding bankruptcy can seem daunting, but it’s worth the sacrifice. As you continue to search for ways to cut costs, Actsoft’s Advanced Wireless Forms (AWF) could help you stash some extra cash. The average office worker uses about 10,000 sheets of paper every year in the U.S., which means companies are spending more than $120 billion a year on printed forms. Some companies are spending thousands of dollars a year in printing forms alone.

Actsoft’s AWF saves your company money while giving your mobile workforce the accessibility that they need from the field. AWF can help turn your paper forms into digital ones so that your mobile employees can fill out and submit forms from the field. With the versatile features of AWF, you can create fields that auto-calculate equations, and capture signatures or photos from jobs. You can also create forms based on decision logic, which will allow you to create fields that display predetermined choices based on other questions in the form.

Filing for bankruptcy can seem like a constant threat to businesses across the board. Having a meticulous budget, discipline to stick with the budget, and keeping a keen eye for detail will help keep your business afloat. Advanced Wireless Forms provides you with the flexibility to streamline workflow while cutting costs and keeping your business productive.

Have any questions on how Actsoft can help you?

Call (888) 732-6638 or Receive a Live Webinar

Encore & Geotab Drive

Encore & Geotab Drive

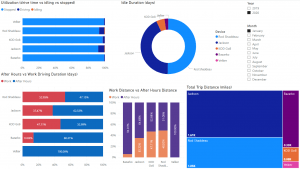

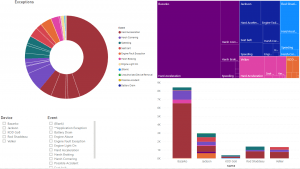

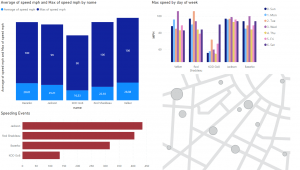

Gain even greater insight into the daily activities of your fleet using the combination of Geotab and Actsoft. Geotab devices provide detailed data collection and seamless integration with our solutions; learn more about the ways your vehicles are being used daily with the power of this tandem.

Gain even greater insight into the daily activities of your fleet using the combination of Geotab and Actsoft. Geotab devices provide detailed data collection and seamless integration with our solutions; learn more about the ways your vehicles are being used daily with the power of this tandem.

Actsoft partnered with Odin to provide our solutions overseas, through payment processing integrations. Odin helps us support user management for our software; customers can also purchase our products through Odin’s billing platform.

Actsoft partnered with Odin to provide our solutions overseas, through payment processing integrations. Odin helps us support user management for our software; customers can also purchase our products through Odin’s billing platform.

VisTracks powers our Electronic Logging Device (ELD) solution, which enables transportation businesses to easily automate their hours of service logs, remain in governmental compliance, and reduce their potential to incur costly fines.

VisTracks powers our Electronic Logging Device (ELD) solution, which enables transportation businesses to easily automate their hours of service logs, remain in governmental compliance, and reduce their potential to incur costly fines. Integration between Actsoft solutions and BeWhere’s software products is available. Take your team’s asset tracking, cellular data connectivity, and field insight a step further with effective, cross-application compatibility.

Integration between Actsoft solutions and BeWhere’s software products is available. Take your team’s asset tracking, cellular data connectivity, and field insight a step further with effective, cross-application compatibility.

CalAmp tracking devices for vehicles and assets alike are compatible with Actsoft solutions, making it easy for you to efficiently monitor your equipment and fleet cars. Help your team enhance accountability, safety, and savings through a combination of easily installed hardware and intuitive software.

CalAmp tracking devices for vehicles and assets alike are compatible with Actsoft solutions, making it easy for you to efficiently monitor your equipment and fleet cars. Help your team enhance accountability, safety, and savings through a combination of easily installed hardware and intuitive software. Our partnership with Uniden is ideal for companies looking to gain advanced diagnostics on their fleets. Uniden’s extensive product listing of car electronics like radios, dash cams, radar detectors, and in-vehicle communicators work in concert with Actsoft’s solutions to better connect your vehicles to the company headquarters.

Our partnership with Uniden is ideal for companies looking to gain advanced diagnostics on their fleets. Uniden’s extensive product listing of car electronics like radios, dash cams, radar detectors, and in-vehicle communicators work in concert with Actsoft’s solutions to better connect your vehicles to the company headquarters. Kyocera offers a wide range of mobile devices, ranging in design from traditional phones to ultra-durable handset technology. Actsoft is able to equip organizations in a variety of different industries with solutions for improved business, while Kyocera supplies the technology they can flawlessly operate on.

Kyocera offers a wide range of mobile devices, ranging in design from traditional phones to ultra-durable handset technology. Actsoft is able to equip organizations in a variety of different industries with solutions for improved business, while Kyocera supplies the technology they can flawlessly operate on.

Our software is the perfect complement to Apple’s user-friendly technology. Equip your workforce with the devices and solutions it needs for optimized productivity during daily operations with Apple and Actsoft.

Our software is the perfect complement to Apple’s user-friendly technology. Equip your workforce with the devices and solutions it needs for optimized productivity during daily operations with Apple and Actsoft.

Actsoft and Sanyo teamed up to merge intuitive business management software with the technology of today. This partnership allows us to provide you with all the tools your team needs for improved workflows, better coordination, and optimized productivity.

Actsoft and Sanyo teamed up to merge intuitive business management software with the technology of today. This partnership allows us to provide you with all the tools your team needs for improved workflows, better coordination, and optimized productivity. Motorola’s mobile technology works in tandem with our solutions to provide extra versatility to your business practices. Coupled with our software’s features, Motorola’s reliable devices make connecting your workforce simpler than ever to do.

Motorola’s mobile technology works in tandem with our solutions to provide extra versatility to your business practices. Coupled with our software’s features, Motorola’s reliable devices make connecting your workforce simpler than ever to do. We’re able to bundle certain solutions of ours (including our Electronic Visit Verification options) with Samsung devices to help your team achieve as much functionality as possible, while keeping rates affordable. Use these combinations for accurate recordkeeping, improved communication, and smarter data collection in the field.

We’re able to bundle certain solutions of ours (including our Electronic Visit Verification options) with Samsung devices to help your team achieve as much functionality as possible, while keeping rates affordable. Use these combinations for accurate recordkeeping, improved communication, and smarter data collection in the field.